Finmax has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to Finotive Funding. We’ve received over 4 complaints against Finmax.

“Finmax,” a binary options broker situated in Sofia, Bulgaria, has claimed legitimacy since 2016 with a Seychelles license. Despite the platform’s offerings, worries concerning genuineness exist. Marketing strategies such as asset variety and account tiers raise problems. The lack of regulation indicates a potential swindle. Be wary of unregulated businesses; prioritize investigation and transparency. Victims can seek restitution through a chargeback. Recognize fraud strategies including generic names, influencer advertising, unsolicited calls, bogus security, and withdrawal barriers.

Get Your Money Back From These Scammers!

[mychargeback-form]

“Finmax” claims to be a binary options broker situated in Sofia, Bulgaria, with a Seychelles license that has been functioning since 2016. Despite its efforts to market itself as a legitimate company with a custom-built trading platform that offers a choice of expiry periods and trading options, doubts arise about the authenticity and trustworthiness of its operations.

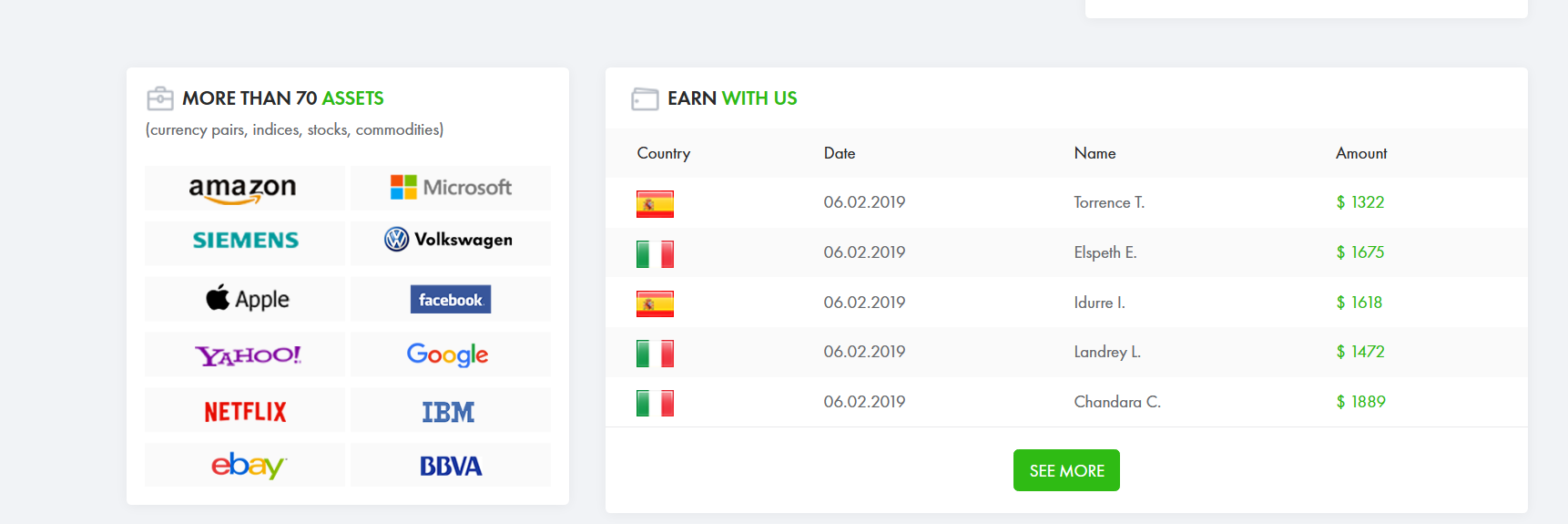

“Finmax” advertises itself as a broker offering over 75 assets, including metals, oils, indexes, and currency pairs, in an attempt to entice users with an allegedly unique platform that allows for mobile trading.

With a sizable proportion of their merchants supposedly being from Russia, they provide their website in both English and Russian. However, the authenticity and usefulness of this platform, which is specifically designed for “Finmax,” are still being scrutinized.

“Finmax” offers a variety of account kinds, each with a different deposit requirement, that appears to be geared to meet the needs of various trader profiles.

These accounts, ranging from Bronze to VIP, are portrayed as doorways to improved trading experiences, however, they may only function as enticements to encourage larger deposits with no matching value.

- Bronze Account: This entry-level account takes a $250 deposit and provides access to over 75 assets with few advantages.

- Silver to Platinum Accounts: As the deposit threshold for a Platinum account rises to $25,000, the claimed benefits increase, such as faster withdrawal times and bonus percentages. However, these benefits appear disproportionate to the investment.

- VIP Account: With a minimum investment of $100,000, this account is said to provide unrivaled perks, raising questions about the true benefits vs the significant financial commitment necessary.

The lack of regulation or the presence of poor regulation is a huge red flag. It means Finmax is a scam and most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of Finmax, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

While “Finmax” claims to provide simple trade kinds such as High/Low and Above/Below, as well as realistic return rates, the veracity of these statements is questioned. The emphasis on short to lengthy expiry durations, along with the allure of huge payments for higher-tier account holders, raises worries about the possibility of misleading traders.

Is Mobile Trading a Facade of Modernity?

“Finmax” advertises its mobile trading capabilities as an example of technological innovation and trader convenience. However, the utility and security of trading on mobile platforms, particularly with a broker of questionable validity, are controversial.

Deposits and Withdrawals: Is It A Smooth Facade?

The broker requires a $250 minimum deposit, and withdrawal times vary by account type. This arrangement appears to be intended to incentivize greater deposits for ostensibly speedier service, but it might equally be used to keep trading cash for longer than necessary.

Special Features and Customer Support: Is it Genuine or Just Gloss?

Claimed additional features, such as educational tools and demo accounts, are popular services used to establish trustworthiness. Similarly, customer support availability is marketed as broad, but the effectiveness and responsiveness of this service are crucial and frequently unproven.

However, it’s worth noting that many scammers disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, the scammers actually stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

If you want to get your money back from a scammer, you’d need to file a chargeback.

When it comes to scammers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, scammers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Scammers understand that in order to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, the customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

The broker’s strategy includes appealing bonuses and promotions, which may be used to divert attention away from the fundamental risks and realities of binary options trading. Such incentives could potentially mask the financial risks involved.

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

Scammers like Finmax tend to purchase fake reviews for their online profiles to make themselves seem more credible.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust Finmax reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews that are posted by temporary accounts (profiles which only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Finmax, chances are, you wouldn’t find many legitimate reviews.

Another prominent way scammers like Finmax enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “Finmax reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising Finmax.

You should always look out for consumer complaints. In the case of Finmax, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees and charges

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Finmax? You can share your complaint in the comment section or submit an anonymous tip.

Finmax aims to establish itself as a reliable binary options broker, but the concerns mentioned require careful consideration. Traders need to carefully assess the broker’s statements, considering the risk of misleading claims and the significant risks associated with binary options trading.

It’s important to prioritize thorough research and choose trading platforms known for their integrity and transparency, rather than being solely focused on quick profits.

Finmax is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind Finmax can run away with your money without any prior notice. You should be extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust Finmax?

All the evidence suggests that Finmax is a scam. If you have lost money to them, there is still a chance you can get it back.

To recover your funds, you’d need to file a chargeback.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.